UNDERSTANDING HURRICANE INSURANCE – PROTECTING YOUR HOME FROM NATURE’S FURY

June 4, 2025

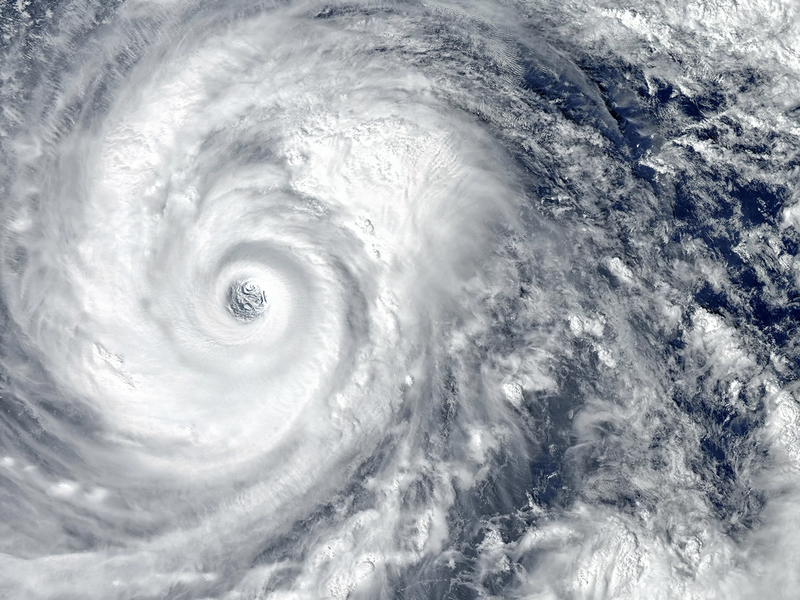

An insurance expert can help assess your risks and coverage options.

When is the worst time to find out your insurance doesn’t cover hurricane damage? After the storm.

Unfortunately, that hard lesson has become far too common in recent years. Take Hurricane Helene, for example. When it tore through Florida, Georgia, and the Carolinas in 2024, hundreds of thousands of homeowners discovered – too late – that their insurance didn’t cover wind or flood damage. By some estimates, more than $30 billion in uninsured losses were sustained—two-thirds of the storm’s total damage.

The Gaps in Homeowners Insurance

Standard homeowners insurance policies often exclude or significantly limit coverage for hurricane-related risks – especially flooding, wind-driven rain, and high winds.

Additionally, hurricanes trigger notable policy limitations in 19 states along the Atlantic Seaboard and Gulf Coast. Once a storm is declared a named hurricane by the National Weather Service, unique exclusions and higher deductibles go into effect and remain in place until the storm is officially downgraded.

Don’t Gamble with Your Financial Security

Without the right coverage, a major storm could leave you with overwhelming out-of-pocket costs. That’s why assessing your risk and securing proper protection is crucial – before hurricane season hits.

Patriot Growth Insurance Services’ local, licensed insurance experts understand the unique risks in your area. We have the experience and market access to help you find the right coverage at the right price – not after the storm, but now.

What Is Hurricane Insurance?

There isn’t a single product called “hurricane insurance.” Instead, our experts can help you build protection by combining a standard homeowners policy with additional coverage that fully addresses hurricane risks.

This added protection can be a small price to pay for the peace of mind it brings.

Key Coverage Considerations

Hurricane coverage is never one-size-fits-all since disaster risks and insurance regulations vary by state. Here are key factors to discuss with your insurance professional:

Hurricane deductibles:

- Unlike a fixed deductible for fire or theft (e.g., $1,000), hurricane deductibles are often 2–10% of your home’s insured value. On a $400,000 home with a 10% deductible, you’d be responsible for the first $40,000 in hurricane damage. Higher deductibles may reduce premiums but can be financially devastating if disaster strikes. Ask if you can “buy down” this deductible by paying a higher premium.

Scope of Coverage:

- Understand what hurricane-related damages are excluded in your policy and whether additional endorsements or riders are available to fill the gaps.

Flood Insurance:

- Flooding from storm surges or torrential rain is not covered by homeowners insurance. Separate policies are available through the National Flood Insurance Program (NFIP) and some private insurers. Lenders typically require flood coverage in high-risk zones, but even if you’re outside those areas, it may still be a wise investment.

The Takeaway

Risk tolerance is personal, but if absorbing massive hurricane-related repair costs threatens your financial stability or peace of mind, adding hurricane coverage could be a wise, proactive decision.

Let Patriot’s knowledgeable, local hurricane insurance experts help you protect your home, finances, and future. Contact us today at contact@patriotgis.com.

Related Posts

Darryl Siry Joins Patriot Growth Insurance Services as Chief Operating Officer

Management & Professional Liability Coverages Every Business Should Know

JM Brassill Group Joins Patriot Growth Insurance Services to Expand Employee Benefits and Consulting Capabilities in New York